AAT vs ACCA vs CA: Which Accounting Qualification Should YouChoose After A/Ls? (2025 Guide)

Introduction

Confused? Don’t know what to do now that you completed you’re A/Ls? Planning to step into accounting, but you have doubts? You’re probably wondering: Should I AAT, ACCA, or CA Sri Lanka?

Each of these accounting qualifications opens up different professional opportunities, with some being obtained sooner and others having more international recognition. The right choice can and will shape your career in finance, accounting, or management.

This guide will break it down for you. We’ll break down AAT vs ACCA vs CA in Sri Lanka, helping you understand which qualification fits your goals best and how Premier Partners Institute of Management (PPIM) can also help you start your career with the confidence it deserves.

What Are AAT, ACCA, and CA?

Who is it best suited for? What do these qualifications mean?

AAT (Association of Accounting Technicians)

This is a foundation-level accounting qualification in Sri Lanka that focuses on practical accounting, bookkeeping, and finance.

- Ideal for: Students who completed their O/Ls or A/ls and is looking to start their accounting journey

- Duration: Around 2 to 2.5 years

- Career Outcomes: Junior Accountant, Audit Trainee, Accounts Assistant.\ • Learn more about AAT at PPIM

ACCA (Association of Chartered Certified Accountants)

It’s a globally recognised qualification for accounting and finance. Accepted over 180 countries! It focuses on international financial reporting, audit, taxation,, and strategic management.

- Ideal for: international careers or multinational company roles.

- Duration: 2.5 – 3 years (depends on exemptions)

- Career Outcomes: Chartered Accountant, Financial Analyst, CFO.

- Explore ACCA Sri Lanka courses at PPIM

CA Sri Lanka (Chartered Accountancy)

A nationally recognised professional qualification that’s highly valued by local firms and audit companies. Offered by CA Sri Lanka (Institute of Chartered Accountants of Sri Lanka)

- Ideal for: Those who wish to work primarily within Sri Lanka in the fields of audit and finance

- Duration: 3-4 years, including practical training

- Career outcomes: Auditor, Tax Consultant, Financial Controller.

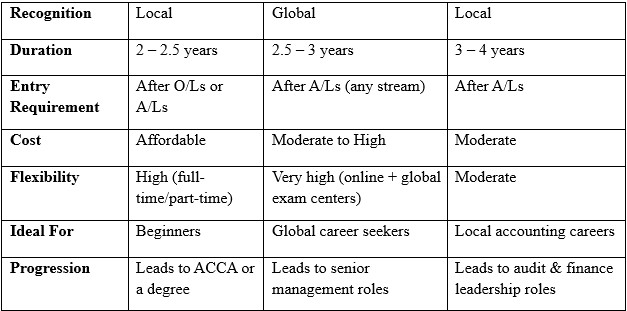

Key Differences: AAT vs ACCA vs CA

Key Benefits & Career Paths

- Why Choose AAT?

- Short duration and flexible learning options.

- Builds a strong accounting foundation for ACCA or CA.

- Excellent choice for those starting immediately after A/Ls.

- Why Choose ACCA?

- Internationally recognized — perfect for overseas work or global companies.

- Covers both technical and strategic aspects of accounting.

- Can be completed while working, offering great flexibility.

- Why Choose CA Sri Lanka?

- Respected by local employers, especially audit firms.

- Strong practical training requirement builds real-world experience.

- Cost-effective and ideal for those staying in Sri Lanka.

Course Structure or Pathway

AAT Pathway

- Foundation level

- Intermediate Level

- Final level

• After completion, you can enter the job market or decide to progress to ACCA with exemptions.

ACCA Pathway

• PPIM provides structured coaching, mock exams, and award-winning lecturers to help students pass efficiently.

CA Sri Lanka Pathway

- Business Level

- Corporate Level

- Strategic Level

• Includes 3 years of practical training, typically under a recognized audit firm.

How to Start/ Enroll After A/Ls

- Make an informed decision about your pathway: if you’re still unsure, contact a counsellor at PPIM – they’ll help you out!

- Entry Requirements: Check whether you’re eligible, most courses accept A/L graduates from any stream.

- Apply Online: Visit PPIM’s Courses Page.

- Early bird gets the worm: reserve your seat early, PPIM offers multiple intakes every year.

- Join Orientation: Be informed, get to know your lecturers, how the course structure works, exam formats and career pathways.

Why Study at Premier Partners Institute of Management (PPIM)?

PPIM is among the most popular accounting education institute in Sri Lanka, which assists students in graduating AAT to ACCA and other levels.

Here’s why you should choose PPIM:

- Award-winning Faculty – Sri Lankan and world ACCA prize-winning lecturers.

- Flexible Learning Options – Full-time and part-time courses in Colombo and Kandy.

- Global Recognition – Official ACCA Silver Learning Partner.

- Support – Mock Examination, revision classes, and individual mentoring.

- Career Guidance – PPIM assists students in networking with the most reputed employers in accounting and finance.

Frequently Asked Questions (FAQs)

What accounting degree would be best to pursue with A/Ls in Sri Lanka?

- In case the main concern is to start as quick as possible, one should consider the AAT credential. The ACCA designation must be chosen in order to have an international recognition. To practice local audit or tax, Chartered Accountant qualification in Sri Lanka is the best selection.

Is it possible to start ACCA before getting AAT?

- Yes. The admission to the ACCA syllabus can be made immediately after an A/L completion, provided that the specified minimum requirements in the English language and academic level are met.

Is ACCA harder compared to CA?

- Both degree programmes are rather rigorous, but ACCA is based on the global accounting practices and business strategy, and CA is more focused on the Sri Lankan practice and professional orientation.

Can a student graduate with AAT and then study ACCA?

- Indeed. AAT is the starting point of many candidates as they develop professionally in an attempt to gain a formidable ground before becoming a member of ACCA, thus making it to be an easy entry into international careers.

How do I choose between AAT, ACCA, and CA?

- Choose AAT if you’re starting from the basics

- Choose ACCA for international exposure

- Choose CA Sri Lanka for a strong local career.

Conclusion

Choosing between AAT, ACCA, and CA Sri Lanka depends on your goals — whether you want to work locally, build an international career, or gain a practical foundation.

At Premier Partners Institute of Management (PPIM), you’ll find expert guidance, flexible study options, and internationally aligned teaching that help you succeed whichever path you choose.

Ready to start?

Talk to a PPIM Counsellor or Apply Now to join our next intake.

Your accounting career starts here — with PPIM.